The construction industry should brace for a steep drop in business over the next six months, according to the latest Consensus Construction Forecast, released in January by the American Institute of Architects (AIA).

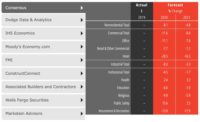

The semi-annual forecast, which is compiled in conjunction with top economists, predicts that there will be an average 11.1 percent drop in non-residential construction spending in the first half of 2009. The rate is more than 10 times that of the last six months of 2008, when non-residential construction output was forecasted to dip 1.2 percent, for the first decrease in years.

In the current forecast, which includes data provided by Moody’s, FMI, Global Insight, Reed Business Information and McGraw-Hill Construction, some sectors fare far worse than others. Hotel construction, for example, could post a 20.2 percent loss, the largest in the survey, while power plants and factories might see a 11.2 percent cut.

No sector comes out unscathed, including publicly funded projects. To wit: even spending on firehouses and police stations, which are lumped under the “public safety” category, could shrink 3.5 percent. In contrast, in 2008, that sector was predicted to grow by 5.9 percent.

Construction companies have already seen troubling signs. Fluor, one of the world’s larger builders, has seen some oil and gas companies, which make up half of its clients, postpone two-thirds of their projects. “Some companies wanted refineries to go next summer,” says spokesman Keith Stephens. “But now they say, if it gets done in the fourth quarter, we will be okay with that.”

Others tied to the construction industry also are deeply concerned. “What’s happened in the last eight months is something nobody has seen before,” says James Hall, a principal at Kimley-Horn and Associates, an engineering and planning firm. Hall, who focuses on shopping centers in Texas, notices that banks are green-lighting fewer new projects, which he doesn’t expect to change soon. “If there is less capital in the market,” he says, “there is less construction going on.”

Historically, architects’ billing numbers have been canaries in the coal mine for builders; if they go down, builders will suffer, too, about nine to 12 months later. And the numbers in this cycle don’t bode well.

The AIA’s Architecture Billings Index, which is compiled from statistics provided by firms, has hovered below 50 for 11 straight months, and anything below 50 represents a billing decrease. In November, the index hit 34.7, the lowest point in its 13-year history.

“What’s happened to architects over the last few months is just now beginning to hit the construction industry,” says Stephen Jacobs, FAIA. His New York firm, Stephen Jacobs Group, has put up 20 hotels in the past three decades. Last year, it experienced a 25 percent plunge in business.

One wild card is whether the $130 to $160 billion assigned to construction in the $838 billion economic stimulus plan can offset the downturn for builders. Andrew Goldberg, the AIA’s chief lobbyist, who’s urged Capitol Hill to target school, transit, and “green” building projects with the money, is hopeful. “It’s a good start,” Goldberg says.

On the plus side, the recession has led to price reductions on many commodities used in construction projects, like steel, gypsum, lumber and cement, according to economists. Copper, which is used for pipes and wiring, for example, has also grown cheaper, from a price of more than $3.50 a pound in July to $1.48 on January 27.

And looking to 2010, the forecast does feature a few bright spots, like amusement parks, which could see a 1 percent growth in construction spending. That pleases architect Jim Scheidel, a principal of the Minneapolis-based Cuningham Group Architecture, which has many theme parks to its credit. Though Scheidel is skeptical that huge gains are ahead, as attendance is down across the board, parks do need to add new rides and pavilions, he says, “to keep people coming.”

Read more economic news in our Recession and Recovery special section.